Amid growing concerns, some analysts speculate that China's digital yuan, a central bank digital currency (CBDC), could pose a challenge to the U.S. dollar's dominance in the global financial system. However, while the digital yuan represents a significant technological advancement, it is unlikely to displace the U.S. dollar as the world’s reserve currency in the near future. The real threat to the dollar's preeminence would come from internal U.S. policies that undermine global confidence in its financial stability and commitment to open markets.

Understanding the Digital Yuan

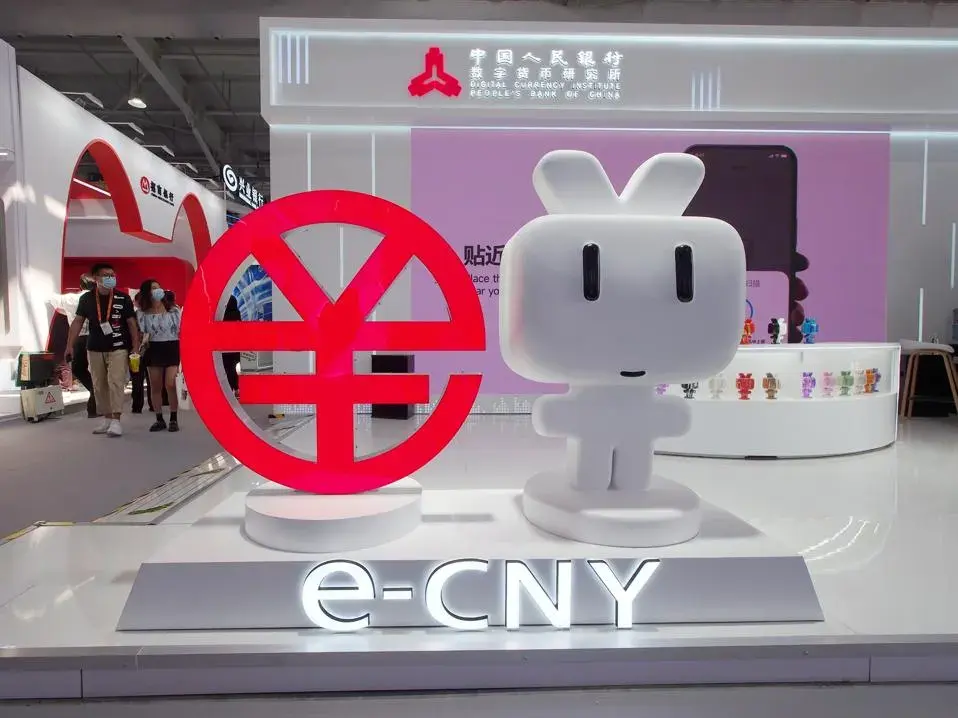

The digital yuan, or e-yuan, is a digital version of China’s currency issued by the People's Bank of China. It functions as a digital equivalent of physical cash, allowing for electronic transactions, digital cash withdrawals, and peer-to-peer transfers. Unlike existing electronic payment systems, the digital yuan is designed to create a government-controlled digital trail, offering the Chinese government unprecedented oversight over financial transactions.

The Chinese government has been aggressively promoting the digital yuan domestically, expanding its availability across 17 provinces and 26 cities, with over 260 million users now on board. To encourage adoption, local governments and state-owned enterprises have begun paying salaries in digital yuan and offering small amounts of the currency to consumers during holidays.

Transactions in the digital yuan surged from 100 billion yuan in the first eight months of 2022 to 1.8 trillion yuan (approximately $250 billion) in the first six months of 2023. While this still represents a small fraction of China’s $3.6 trillion digital payments market, it suggests growing traction among domestic consumers.

The primary competition for the digital yuan comes from China’s established digital payment giants, Alipay and WeChat Pay, which control 90% of the market. Alipay alone had 1.3 billion users as of 2021, while WeChat Pay boasted 900 million users. These platforms are deeply integrated into Chinese consumers’ daily lives, making it challenging for the digital yuan to gain market share. However, the Chinese government’s planned introduction of a universal QR code and other features may tilt the balance in favor of the digital yuan.

Currency as a Soft Power Tool

A Deutsche Bank report recently highlighted the potential for CBDCs to be used as soft power tools, potentially disrupting the dominance of the U.S. dollar and the SWIFT financial messaging system. China’s success with the digital yuan has caught the attention of other nations looking to modernize their financial systems and enhance their roles in the digital economy. The Bank for International Settlements predicts that 24 central banks could launch some form of digital currency by 2030, with several major economies, including the European Central Bank, India, and Brazil, planning pilot programs.

In October 2022, China conducted a small-scale pilot of a cross-border payment platform called m-Bridge, in collaboration with the central banks of the UAE, Hong Kong, and Thailand. A working version of m-Bridge could be released by the end of the year, potentially providing an alternative to SWIFT and traditional correspondent banking networks.

CBDCs offer several advantages, including reduced transaction costs, increased security, prevention of counterfeiting, and improved financial inclusion. However, the notion that the digital yuan could replace the U.S. dollar as the backbone of global trade has raised concerns in Washington.

The Resilience of the U.S. Dollar

The U.S. dollar currently dominates global finance, being used in 88% of foreign exchange trades in 2022, despite the U.S. accounting for only 11% of global trade. The dollar also constitutes 60% of global foreign exchange reserves. This dominance allows the U.S. to finance its government debts and maintain a persistent trade deficit without triggering runaway inflation. Additionally, the dollar’s status gives the U.S. unique leverage to enforce sanctions and combat money laundering through its control over correspondent banks and the SWIFT system.

For the digital yuan to challenge the dollar’s status as a global reserve currency, China would need to undertake significant financial liberalization, including removing capital controls, enabling full convertibility of the yuan, and increasing transparency in its economic data. Given the current structure of China’s financial system, it is unlikely that Beijing will make these changes in the near future, limiting the digital yuan’s ability to function as a global reserve currency.

The Prospect of a Digital Dollar

While the U.S. has been cautious in its approach to CBDCs, the Federal Reserve has begun exploring the potential of a digital dollar. Last year, the Fed released a white paper and launched a research project with the MIT Digital Currency Initiative. However, Federal Reserve Chairman Jerome Powell has made it clear that launching a U.S. CBDC would require congressional approval. The issue has already become politically contentious, with some presidential candidates vowing to block the introduction of a digital dollar.

Despite these challenges, the U.S. would be wise to continue researching a CBDC, particularly for enhancing the efficiency of cross-border transactions and global trade. The existing SWIFT system, which dates back to the 1970s, can take days to clear transactions. Although the new FedNOW system speeds up transactions, it lacks some of the features offered by a CBDC. If other major economies gain traction with digital currencies that can clear transactions in seconds, the dollar's status could be at risk.

Conclusion

For now, the U.S. dollar’s role in the global economy remains secure, supported by the depth of America’s capital markets, trust in its government securities, and a commitment to an open financial architecture. The greatest threat to the dollar’s dominance is not the digital yuan but rather self-inflicted wounds, such as overuse of financial sanctions or fiscal mismanagement. Preserving the dollar’s strength requires maintaining the policies and practices that have made it the world’s reserve currency.